Sekitar Dunia Unik - Apa jadinya jika atap rumah tiba-tiba berubah menjadi berwarna oranye. Bukan hanya satu rumah saja, melainkan satu De...

Wanita Ini Tidur Selama 22 Jam Sehari. Inikah Putri Tidur di Dunia Nyata??

Sekitar Dunia Unik - Biasanya seseorang tidur 7 sampai 8 jam dalam sehari. kalau pun lebih, kemungkinan besar ia akan tidur paling lam...

Restoran-Restoran yang Pelayannya Bukan Manusia

Sekitar Dunia Unik – Pada umumnya setiap restoran memiliki pelayan yang terdiri dari para karyawan yang sudah terlatih. Restoran dipilih se...

10 Buah Unik yang Belum Pernah Anda Temui

Sekitar Dunia Unik – Anda tentu mengenal bermacam buah-buahan, seperti pepaya, pisang, apel dan jeruk, dimana buah-buahan tersebut t...

India Ngotot Usulkan Neyyappam Sebagai Nama Penerus Android Series

HendraDigital

Sekitar Dunia Unik - Kabar baik dari Android nih. Pasalnya, Google tengah memilih nama yang cocok untuk Series berikutnya setelah ya...

Astaga! Pria Ini Telan Handphone Miliknya Sendiri

HendraDigital

Sekitar Dunia Unik – Seperti dilansir dari laman dailymail.co.uk , seorang pria asal Irlandia yang tidak disebutkan namanya ini, beber...

Fakta Mengejutkan Tentang Pulau Ular

HendraDigital

Sekitar Dunia Unik – Apa jadinya jika sebuah pulau dihuni oleh salah satu spesies paling berbahaya di muka bumi? Sebuah pulau yang jau...

Segelas Kopi dan Kurma Dijadikan Mahar?

HendraDigital

Sekitar Dunia Unik – Lazimnya, mahar atau mas kawin berupa benda-benda yang bermanfaat, semisal emas perhiasan atau seperangkat alat s...

Pria Ini Baru Sadar Dirinya Hamil Saat Usia Kandungan Dua Bulan

HendraDigital

Sekitar Dunia Unik – Seorang pria asal Islandia, Henry Steinn, melahirkan seorang bayi perempuan yang cantik. Ia menyadari jika diriny...

Ssst!! Bus Ini Menyediakan Kursi Kelambu. Untuk Apa Ya??

Sekitar Dunia Unik – Rasa nyaman dan aman saat menyusui, sudah pasti akan memberikan rasa tenang bagi ibu-ibu yang memberikan ASI eks...

Inilah Ponsel Layar Lipat Dari Samsung

HendraDigital

Sekitar Dunia Unik - Sebuah laporan terbaru mengatakan, pengembangan teknologi ponsel layar lipat yang bernama Project Valley tengah d...

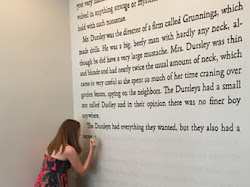

Karena Ngefans, Tembok Dilukis Novel Harry Potter

Sekitar Dunia Unik – Bagi seseorang yang memang ngefans atau menyukai sesuatu, maka apapun akan dilakukan agar selalu merasa dekat den...

Inilah Alasan Mengapa Pria Dilarang Memakai Emas

Sekitar Dunia Unik - Seperti dikutip dari situs mitradjaya.com , berikut ini : Satu lagi, “Bukti Keilmiahan h ukum -hukum Islam dan s ...

Tiang Bendera Tertinggi Di Dunia

Sekitar D unia Unik - Tiang bendera memiliki fungsi utama sebaga i penyangga bendera yang dikibarkan diatas tiang. Masi...

Domba Aneh ini Menghebohkan Dunia

Sekitar Dunia Unik – Anda tentu sering mendengar tentang domba atau kambing yang lahir kurang sempurna, seperti lahir dengan kondisi tiga ...

Mengerikan! Ikan Ini Hidup Lagi Setelah Disiram Alkohol

Sekitar Dunia Unik – Dalam dunia kuliner, sajian ikan atau hewan laut diatas piring merupakan sajian yang terbilang nikmat dan diminati ol...

Foto Bayangan yang Membuat Anda Bengong

Sekitar Dunia Unik – Gambar bayangan yang dipantulkan ketika mengambil foto, acapkali menghasilkan bentuk yang unik atau bahkan terlihat a...

Inilah 10 Jalur Kereta yang Extreme

Sekitar Dunia Unik - Jalur kereta api yang umum adalah bertepatan di daratan biasa yang datar, namun ternyata ada juga rute kereta api ya...

Inilah 4 Negara yang Ditakuti Amerika

Sekitar Dunia Unik - Negara Amerika terkenal akan kecanggihan teknologinya yang memang sudah diakui oleh dunia. Berkat hal inilah, tidak ...

Grace Gelder, Wanita yang Menikahi Dirinya Sendiri

Sekitar Dunia Unik - Sebelumnya Admin sudah menulis artikel tentang keanehan 7 Orang yang Menikah Dengan Hewan . Dan pada artikel kali i...

7 Orang yang Menikah Dengan Hewan

Sekitar Dunia Unik - Pernikahan lazimnya dilakukan atas dasar suka sama suka dengan berlandaskan cinta dan kasih sayang antar sesama jenis...

Deretan Tas Unik Ini Memiliki Bentuk Menyerupai Benda-Benda!

Sekitar Dunia Unik - Dunia fashion selalu saja menelurkan deretan hal unik di dalamnya, seperti salah satunya, yakni tas yang berbentuk b...

Wanita Ini Menggambar Wajah Pada Buah Pisang

HendraDigital

Sekitar Dunia Unik – Bagi seorang yang memiliki tingkat kreatifitas serta imajinasi yang tinggi, media untuk menggambar dapat dilakukan ti...

Sering Kram Tengah Malam? Ini Penyebab dan Solusinya

Sekitar Dunia Unik – Apakah pembaca setia blog Sekitar Dunia Unik ada yang pernah atau sering mengalami kram ketika tertidur pada malam h...

Kebudayaan dan Kekayaan Alam Indonesia di Mata Uang Rupiah

Sekitar Dunia Unik – Indonesia adalah bangsa yang kaya akan kebudayaan, keindahan alamnya, keragaman suku dan bahasa. Salah satu langkah...

Inilah Daftar Lautan Paling Angker dan Mengerikan di Indonesia

HendraDigital

Sekitar Dunia Unik – Samudera selalu saja memiliki beragam cerita misteri dan mengerikan , seperti kapal yang tenggelam maupun pesawat j...

Temukan 10 Hal Unik Berikut Hanya di Australia

Sekitar Dunia Unik – Banyak sekali fakta unik yang bisa kita dapatkan dari berbagai belahan di dunia ini, baik itu dari segi kehidupan man...

5 Tokoh yang Menyelamatkan Masa Kecil Anda

Sekitar Dunia Unik – Bagi Anda generasi yang lahir pada tahun 80-an dan 90-an, sudah sepantasnya mensyukuri masa kecil yang begitu bahagia...

8 Penemuan Terbesar Dalam Peradaban Manusia

Sekitar Dunia Unik - Sepanjang perjalanan hidup manusia di bumi ini, telah mengalami banyak sekali penemuan penting demi kesejahtera...

Mengerikan! Ada Hewan Hidup di Dalam Hidung Wanita Ini

Sekitar Dunia Unik – Bagaimana jadinya jika ada hewan yang hidup di dalam organ tubuh seseorang? Hal inilah yang dialami oleh seorang wani...

New Century Global Center, Bangunan Terluas di Dunia

HendraDigital

Sekitar Dunia Unik – Mau tahu gedung terluas di dunia ? Ternyata gedung terluas di dunia memang benar-benar ada. Di Tiongkok, ada sebuah g...

8 Orang yang Mengalami Kematian Ala Film Final Destination

Sekitar Dunia Unik – Anda pernah menyaksikan tayangan film Final Desnitation? Film Hollywood ini menceritakan perjalanan tentang beb...

Inilah 7 Perusahaan Besar Amerika yang Mendukung Gerakan LGBT

Sekitar Dunia Unik - Kaum LGBT (Lesbian Gay, Biseksual dan Transgender) sepertinya semakin mendapat tempat di hati bagi sebagian orang di ...

Inilah 10 Racun Paling Mematikan di Dunia

HendraDigital

Sekitar Dunia Unik - Racun merupakan senyawa kimia berbahaya yang seharusnya tidak boleh berada di dalam tubuh, terutama tubuh manusia. Ka...

Subscribe to:

Posts (Atom)